PDF editing your way

Complete or edit your i 797 form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export i 797 form pdf directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your i 797 form download pdf as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your i 797 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form I-797

About Form I-797

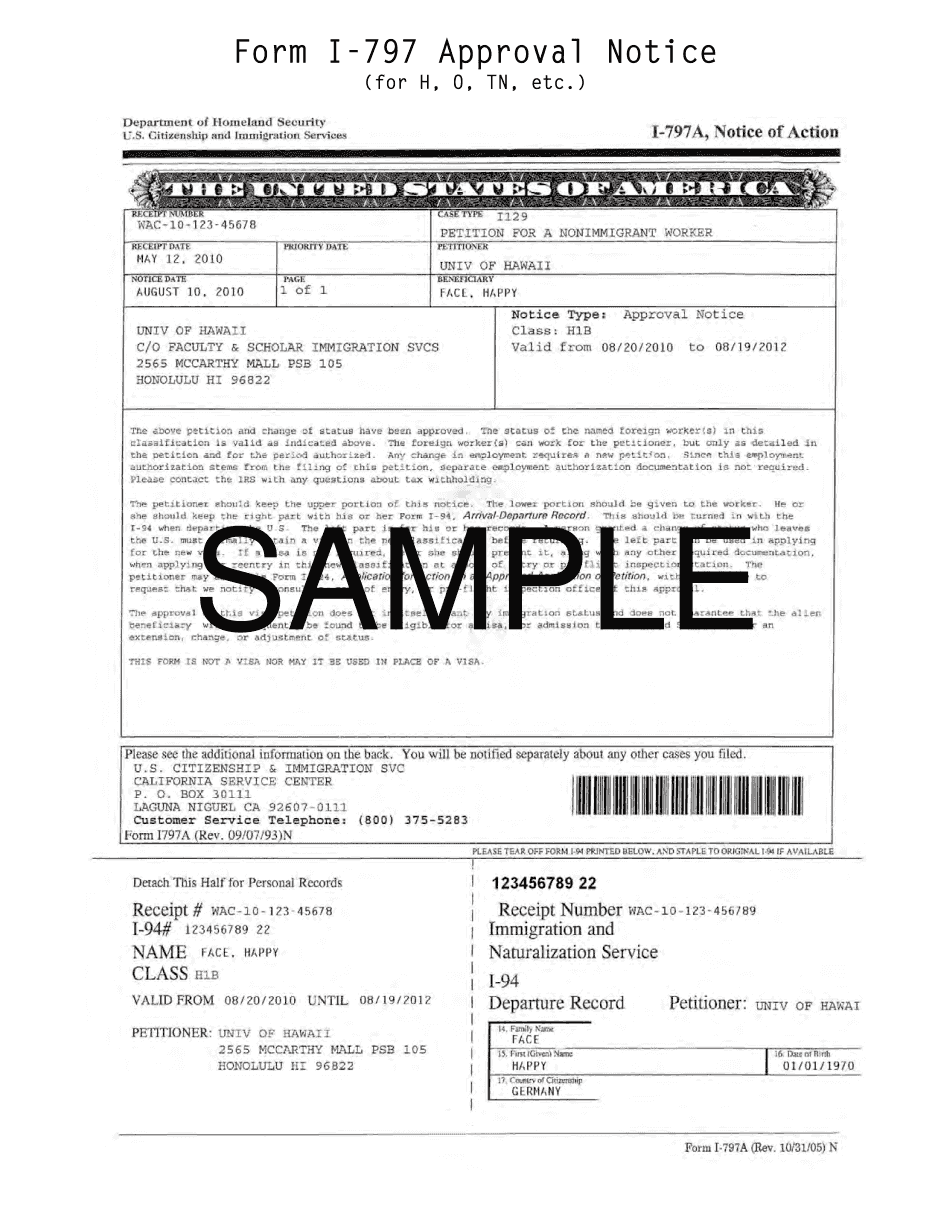

Form I-797 is a Notice of Action issued by the United States Citizenship and Immigration Services (USCIS). It serves as official documentation to notify recipients about the status of their immigration application or petition. Various types of Form I-797 exist, but they are commonly used in the following scenarios: 1. Approval Notice: This type of I-797 is issued when an individual's immigration request or petition has been approved, such as an employment-based visa, family-based visa, or adjustment of status. 2. Receipt Notice: It is issued to acknowledge that the USCIS has received an application or petition and is currently processing it. It typically includes information such as receipt number, filing date, and instructions regarding any further action. 3. Transfer Notice: When the USCIS transfers a case to a different office or jurisdiction, a Transfer Notice (Form I-797) is issued to notify the applicant or petitioner about the transfer and the new office location. 4. Request for Additional Evidence: If the USCIS requires more evidence or documentation for an application or petition, a Request for Evidence (RFE) may be issued as an I-797. It details the evidence needed and provides instructions on how to respond. 5. Interview Notice: In scenarios where an immigration interview is required, the USCIS issues an interview notice (Form I-797) specifying the interview date, time, and location. 6. Denial Notice: Occasionally, if an immigration application or petition is denied, the USCIS may issue a Denial Notice (Form I-797) explaining the reasons for denial and providing information about potential appeal options. Form I-797 is essential for individuals who have filed immigration applications or petitions. It serves as proof of their application or petition's status, approval, transfer, or any requested action from the USCIS. Therefore, applicants or petitioners must carefully review this notice and comply with any instructions provided within it.

What Is I-797 Form?

Form I-797 is an Approval Notice or Notice Of Action. It is issued to individuals after their petitions or applications submitted to USCIS are approved in order to verify an approval. This form is also a result of a foreigner`s request to change his/her one nonimmigrant classification to another and is always issued by USCIS. So, in order to have your documents approved and receive such approval form, you should submit a duly prepared application and all requested supplementary documentation.

There are several types of this form which can be used for various purposes. For instance, it can be issued to an individual as a replacement of an I-94 form or as an approval of an alien worker petition or in order to request evidence.

Draw your attention to the fact that such form isn`t that one you can fill out yourself. We offer you to view an I-797 Form sample in PDF on our website. According to the sample a document includes the following information:

- date of receipt of an application submitted by a foreign national;

- number of receipt;

- date of notice issurance;

- number of pages on which document is placed;

- petitioner`s name;

- beneficiary`s name;

- type of notice and period of its validity.

The main text of a form includes information regarding approval of a certain application and further instructions. The upper part of a form is for a petitioner and the lower part is kept by a beneficiary.

Online alternatives assist you to organize your doc management and increase the productiveness within your workflow. Comply with the quick manual to total Form I-797, stay clear of problems and furnish it in a very timely manner:

How to finish a Form I-797 on-line:

- On the web site with the type, click Begin Now and go to the editor.

- Use the clues to fill out the relevant fields.

- Include your individual material and make contact with data.

- Make sure you enter correct data and figures in appropriate fields.

- Carefully take a look at the content material belonging to the sort likewise as grammar and spelling.

- Refer to aid section should you have any queries or handle our Assist team.

- Put an digital signature on your Form I-797 with all the guide of Indication Software.

- Once the shape is accomplished, push Finished.

- Distribute the all set type via e mail or fax, print it out or save on your product.

PDF editor permits you to definitely make improvements towards your Form I-797 from any internet related equipment, personalize it according to your requirements, indicator it electronically and distribute in different methods.